FDIC Insurance Coverage

FDIC insurance covers all types of deposits received at an insured bank, including deposits in a checking account, negotiable order of withdrawal (NOW) account, savings account, money market deposit account (MMDA), time deposit such as a certificate of deposit (CD), or an official item issued by a bank (such as a cashier’s check or money order).

FDIC insurance covers depositors’ accounts at each insured bank, dollar-for-dollar, including principal and any accrued interest through the date of the insured bank’s closing, up to the insurance limit.

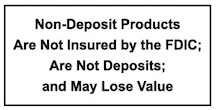

The FDIC does not insure money invested in stocks, bonds, mutual funds, life insurance policies, annuities or municipal securities, even if these investments are purchased at an insured bank.

The FDIC does not insure safe deposit boxes or their contents.

The FDIC does not insure U.S. Treasury bills, bonds or notes, but these investments are backed by the full faith and credit of the United States government.

How much insurance coverage does the FDIC provide?

The standard deposit insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.

The FDIC insures deposits that a person holds in one insured bank separately from any deposits that the person owns in another separately chartered insured bank. For example, if a person has a certificate of deposit at Bank A and has a certificate of deposit at Bank B, the accounts would each be insured separately up to $250,000. Funds deposited in separate branches of the same insured bank are not separately insured.

The FDIC provides separate insurance coverage for funds depositors may have in different categories of legal ownership. The FDIC refers to these different categories as “ownership categories.” This means that a bank customer who has multiple accounts may qualify for more than $250,000 in insurance coverage if the customer’s funds are deposited in different ownership categories and the requirements for each ownership category are met.

Ownership Categories

This section describes the following FDIC ownership categories and the requirements a depositor must meet to qualify for insurance coverage above $250,000 at one insured bank:

- Single Accounts – owned by one person. $250,000 per owner

- Certain Retirement Accounts – includes IRAs. $250,000 per owner

- Joint Accounts – owned by two or more persons. $250,000 per co-owner

- Revocable Trust Accounts – $250,000 per each unique beneficiary, up to 5 beneficiaries (more coverage available with 6 or more beneficiaries subject to specific limitations and requirements).

- Irrevocable Trust Accounts – $250,000 for the non-contingent, ascertainable interest of each plan beneficiary.

- Employee Benefit Plan Accounts –$250,000 for the non-contingent, ascertainable interest of each plan participant.

- Corporation/Partnership/Unincorporated Association Accounts – $250,000 per corporation, partnership or unincorporated association.

- Government Accounts – $250,000 per official custodian

To calculate your deposit insurance coverage: Use the FDIC’s Electronic Deposit Insurance Estimator (EDIE) at: http://www.fdic.gov/edie